Group now ranks in the Top 25 “Corporate Startup Stars”

ENGIE has joined the world’s 25 most active companies in terms of open innovation and has been awarded a “Corporate Startup Stars” award by the international organisation Mind The Bridge and the International Chamber of Commerce.

Over a hundred startups nominated the world’s 50 most active organisations in terms of collaboration with startups, placing ENGIE in the Top 25 “Corporate Startup Stars” and the Top 25 “Open Innovation Challengers”.

Over a hundred startups nominated the world’s 50 most active organisations in terms of collaboration with startups, placing ENGIE in the Top 25 “Corporate Startup Stars” and the Top 25 “Open Innovation Challengers”.

ENGIE is one of 25 leading organisations rewarded for their strategy, their processes and their culture of innovation. The Group was lauded for the quality of its sourcing and incubator initiatives and for its investment in startups with disruptive business models.

“Open innovation is key for ENGIE. It’s a way of co-constructing the energy solutions of the future in order to achieve our carbon neutrality goals by 2050. Our open innovation ecosystem comprises varied structures such as incubation and excubation, R&D, intrapreneurship, calls for projects and partnerships with startups,” says Csilla

Kohalmi-Monfils, Director of Innovation Ecosystems at ENGIE.

“Through our ENGIE New Ventures fund, we act as a strategic investor for many startups in a range of fields including green gas (hydrogen), decentralised energy, energy efficiency and energy storage. Our intervention goes well beyond financial support for innovative projects: we want to facilitate the creation of genuine partnerships that give rise to long-term collaborations,” explains Johann Boukhors, Managing Director of ENGIE New Ventures.

26 startups supported since 2014

The €180 million ENGIE corporate investment fund has invested €140 million since 2014 in 26 startups with disruptive business models. ENGIE New Ventures brings startups its portfolio of ENGIE core skills and nurtures opportunities for collaboration with the Group’s entities and clients. Thanks to its multi-local presence in Europe, the USA, Asia, Latin America and Israel and its dedicated governance, ENGIE’s venture capital investment subsidiary acts as a catalyst for innovation in support of energy transition.

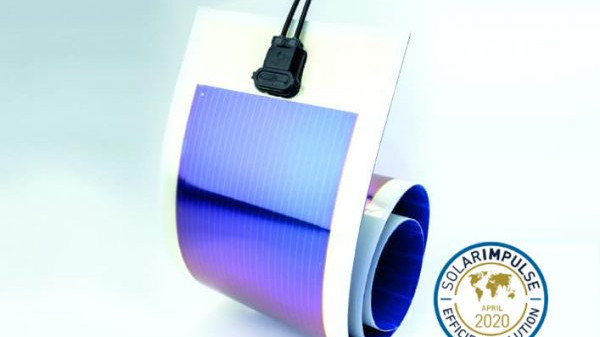

In 2020, for example, ENGIE New Ventures supported the hydrogen technology platform H2SITE; the world’s leading provider of cloud-based energy data management solutions Energyworx; the German startup Heliatek, which develops photovoltaic films that allow buildings to achieve carbon-neutral energy consumption; and Redaptive Inc., which provides “Efficiency-as-a-Service” solutions for buildings.

[1] ABB, AB InBev, Autodesk, BBVA, BNP Paribas, BNY Mellon, Bosch, BP, Enel, ENGIE, Hewlett Packard Enterprise, HSBC, Iberdrola, KPN, Mastercard, NESTLÉ, PepsiCo, Samsung, SAP, Schneider Electric, Shell, Siemens, Sodexo, Telefónica and Vodafone.

About ENGIE New Ventures

ENGIE New Ventures (ENV) is the corporate venture arm of ENGIE, the global energy and services provider. ENGIE is committed to lead the energy revolution, towards a more decarbonized, decentralized and digitized world. ENV is a €180 million investment fund focused on making minority investments in innovative startups. Since 2014, ENV has deployed €140 million of capital across 26 investments, in disruptive startups leading the energy transition and active in energy efficiency, renewable energy, energy storage and demand response, mobility and IoT.. ENV’s offices are represented in Paris, San Francisco, Singapore, Mexico and Tel Aviv. Please visit: www.engieventures.com.

About ENGIE

Our group is a global reference in low-carbon energy and services. Our purpose (“raison d’être”) is to act to accelerate the transition towards a carbon-neutral world, through reduced energy consumption and more environmentally-friendly solutions, reconciling economic performance with a positive impact on people and the planet. We rely on our key businesses (gas, renewable energy, services) to offer competitive solutions to our customers. With our 170,000 employees, our customers, partners and stakeholders, we are a community of Imaginative Builders, committed every day to more harmonious progress.

Turnover in 2019: 60.1 billion Euros. The Group is listed on the Paris and Brussels stock exchanges (ENGI) and is represented in the main financial indices (CAC 40, DJ Euro Stoxx 50, Euronext 100, FTSE Eurotop 100, MSCI Europe) and non-financial indices (DJSI World, DJSI Europe and Euronext Vigeo Eiris – World 120, Eurozone 120, Europe 120, France 20, CAC 40 Governance).

Press contact

Le Public Système PR – engiefab_r&t@lepublicsysteme.fr – 01 55 78 27 68 / 01 41 34 18 62

In the news

June 13, 2022

Meet ENGIE New Ventures at Viva Technology 2022

June 30, 2020

How ENGIE New Ventures Has Adapted To The Crisis

May 18, 2020

ENGIE New Ventures during Covid-19

February 2, 2020

Gogoro pitch on Change NOW exibition on ENGIE Booth in Paris

January 6, 2020

ENGIE New Ventures & Vyntelligence

November 20, 2019

Japan: NICIGAS connects 850,000 Gas Meters with UnaBiz and SORACOM

September 26, 2019

ENGIE New Ventures invests in smart radiators from Lancey Energy Storage

September 16, 2019

KiWi Power – Winner of Japan Energy Challenge 2019

January 29, 2019

Opus One named as a Global Cleantech 100 company

January 10, 2019

StreetLightData at CES 2019

January 9, 2019

Unabiz at CES 2019

January 9, 2019

HomeBiogas at CES 2019

December 18, 2018

ENGIE at CES 2019 : HomeBiogas

December 13, 2018

Opus One Solutions Closes Series B Funding Led by Renewal Funds

December 12, 2018

ENGIE at CES 2019 : UnaBiz

December 11, 2018

ENGIE at CES 2019 : Streetlight Data

December 6, 2018

ENGIE at CES 2019 : Kiwi Power

December 4, 2018

ENGIE at CES 2019 in Las Vegas

November 2, 2016

ENGIE invests in Serviz and Opus One Solutions

May 31, 2016

Kiwi Power, ENGIE partner startup

February 26, 2016