Coming to the financial rescue of startups: That’s one of the new roles taken on by ENGIE New Ventures — ENGIE’s Corporate Venture Capital Arm created in 2014 in an effort to discover and foster startups driving the energy transition. “In times of crisis, we want to support the needs of our startups as much as possible and to accompany them in the recovery phase,” explains Johann BOUKHORS, the fund’s Managing Director.

Of the 19 companies in the portfolio, five have just been recapitalized for a total of €10 million. And it’s hardly over, with the head of the €180-million fund anticipating an economic crisis stretching across two years. Still, some sectors can also find new momentum, such as digital pioneers. ENGIE New Ventures recently invested in Vyntelligence, a British and Indian AI-driven startup that digitizes industrial and commercial maintenance diagnostics, saving time and resources by limiting the need for on-site troubleshooting.

Including startups in recovery plans

Post-lockdown recovery plans are also an opportunity to be environmentally sustainable. That is especially true in Europe, where ENGIE New Ventures has made half of its investments, while one-third is allocated to companies in the United States and the rest in Asia and Israel. Energy efficiency and low-carbon gases are among the main focus areas of the fund’s 15 team members, along with mobility, digitization and carbon recovery. The fund is at the very forefront of offering new perspectives for startups, by striving to include them into the economic recovery plans.

ENGIE New Ventures has also recently announced its strategic investment in H2Site. Headquartered in Bilbao, H2Site works on the local generation of high-purity hydrogen from membrane-filtered biogas. As ENGIE is contracted to install 20 H2 stations in Auvergne Rhône-Alpes, H2Site’s technology will be explored as an option. Because, just like other corporate funds — such as Total’s for instance — ENGIE New Ventures is not just an investor: “Our involvement goes far beyond a simple financial contribution to innovative ventures; we want to create real partnerships for a mutual beneficial long-term collaboration,” explains Johann BOUKHORS. Besides, with investments averaging €5 million, ENGIE New Ventures’ contribution can border on a takeover, like in 2015 when it increased its stake in Kiwi Power, a British specialist in flexibility (Distributed Energy Resources, battery management), to just under 50% in 2015. Kiwi Power now works with ENGIE in France, England, Belgium and the Netherlands.

Solar power investment pays off …

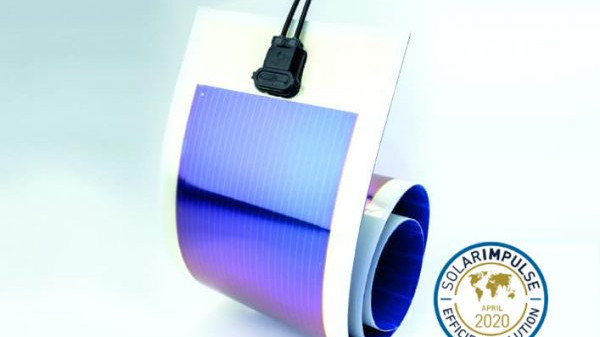

Running a corporate fund is not always easy. Having invested €125 million to date, ENGIE New Ventures has suffered three bankruptcies leading to multi-million losses: namely AirWare (drones), Serviz (home services platform) and Connit, providing autonomous IoT solutions. But with other investments, patience has paid off. Heliatek, a German manufacturer of organic photovoltaic films founded in 2006, is now entering the certification phase and has signed commitments for large orders in 2021. Having also received investments from Innogy, BASF, BNP Paribas and others, Heliatek has an industrial manufacturing capacity of one million square meters per year at its Dresden facilities — for a solar technology that claims around 10% efficiency. ENGIE’s CVC pays particular interest to the promising potential of solar films, a market already explored by the French company Armor and by the now liquidated Sunpartner.

With offices in Paris, San Francisco, Singapore, Santiago, Mexico City and Tel Aviv, ENGIE New Ventures boasts 25 investments in six years, with three failures and three exits since. A twentieth startup will join the current portfolio in the coming weeks.

In the news

June 13, 2022

Meet ENGIE New Ventures at Viva Technology 2022

December 17, 2020

ENGIE’s startup collaboration strategy reaps accolades

May 18, 2020

ENGIE New Ventures during Covid-19

February 2, 2020

Gogoro pitch on Change NOW exibition on ENGIE Booth in Paris

January 6, 2020

ENGIE New Ventures & Vyntelligence

November 20, 2019

Japan: NICIGAS connects 850,000 Gas Meters with UnaBiz and SORACOM

September 26, 2019

ENGIE New Ventures invests in smart radiators from Lancey Energy Storage

September 16, 2019

KiWi Power – Winner of Japan Energy Challenge 2019

January 29, 2019

Opus One named as a Global Cleantech 100 company

January 10, 2019

StreetLightData at CES 2019

January 9, 2019

Unabiz at CES 2019

January 9, 2019

HomeBiogas at CES 2019

December 18, 2018

ENGIE at CES 2019 : HomeBiogas

December 13, 2018

Opus One Solutions Closes Series B Funding Led by Renewal Funds

December 12, 2018

ENGIE at CES 2019 : UnaBiz

December 11, 2018

ENGIE at CES 2019 : Streetlight Data

December 6, 2018

ENGIE at CES 2019 : Kiwi Power

December 4, 2018

ENGIE at CES 2019 in Las Vegas

November 2, 2016

ENGIE invests in Serviz and Opus One Solutions

May 31, 2016

Kiwi Power, ENGIE partner startup

February 26, 2016